Having the “Money Talk” with your Parents Having the “Money Talk” with your parents can be very uncomfortable. However, it is necessary to have now, before it becomes a problem in the future. People tend to not like talking about money or death, so when you combine the two it can cause some discomfort. […]

Blog

Closing the Gap Between your Financial Reality and Goals

Closing the Gap Between your Financial Reality and Goals Most of us are failing miserably with our finances. Personal savings rates are at an all time low, retirements savings are non-existent, and overall net worth is diminishing. Nobody wants to be terrible with their finances, so why are we failing? We’ll take a […]

My Partner has Bad Credit; Can We Buy a House?

My Partner has Bad Credit; Can We Buy a House? You’ve scrimped, saved, and made sure every bill is paid just to be in the perfect position to purchase a property. You’ve got great credit, but how about your partner? Eh, not so much. This is a very common issue that I run into on […]

How Much Is Enough? & The Law of Diminishing Returns

We have the ability to recognize when something benefits us, but at what point does the benefit begin to decrease? Our brains have an amazing capacity to recognize value and encourage us to repeat those behaviors or actions that created that value. The Law of Diminishing Returns is always in effect, but we just may not notice it. The problem lies in the fact that we don’t have a shut-off for this reward seeking behavior. Our brains don’t naturally recognize abundance, and the same desire exists for more, more, more.

Elaine Mahr: Auto Industry Trends

You may have noticed that your auto insurance premiums even if you have made no claims. As a whole, insurance rates are rising across the industry, and companies are scrambling to be profitable. Insurance companies use their loss ratio or the difference of the money they bring in from premiums versus the amount they pay out in claims each year to determine premiums. Elaine Mahr from Farmer’s Insurance is with us to explain some auto industry trends that may be affecting your rates.

Midyear Checkup: Assessing Your Goals At The Midpoint

I am a strong believer in goals. I believe in the power of setting them, re-visiting them, and allowing them to guide our actions. July 4th weekend marked the midpoint of the year. If you created a set of goals at the beginning of the year, now is a good time to review them and measure your progress. If your results have been disappointing, this is a good time to objectively evaluate your progress and take some action.

Budgeting Made Easy

Building a budget may sound complicated, but it is an essential Fundamental Financial Principle. If used properly, budgeting will prevent costly mistakes, increase savings, avoid unnecessary expenses, and improve your overall financial health. I wanted to come up with a foolproof system for creating a budget that works and one that is easy.

Streamline Your Finances: 5 Phases

Dealing with bills, documents, and how your money comes in and out can be a complicated process. However, I believe the task can be simplified. I want to share with you my methodology to streamline your finances. There was a time when I would spend 8 hours EACH month working on my finances. Now, I have it down to about 30 minutes. Read on to find out how I was able to do this.

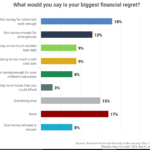

Biggest Financial Regrets

It’s hard to get through life without at least one major financial regret. That’s the conclusion from a new Bankrate nationwide survey that finds only 17% of Americans say they have no money decisions they’d want to take back.

How To Pay Down Credit Card Debt: 6 Tips

Americans now owe more than $1 Trillion in credit card debt, and the average family owes over $16k! If you are one of the many Americans struggling with credit card debt, then these tips are for you. Credit cards can be a nice way to build credit if managed properly. Ideally they are used and paid off each month, but if you have found yourself in a situation where the debt is getting out of control follow these tips to reduce spending to start paying that card off.