How to Work Back-to-School Into Your Budget Try this little mantra called the 50/20/30 Rule. What that means is: 50% of your monthly income should go toward your essential expenses like housing, utilities and groceries. 20% should go toward your financial priorities like debt payments, retirement accounts, college savings and emergency fund. The last 30% […]

Financial Advisor

Bailout Scorecard Update

The Bailout Scorecard Last update: Mar. 31, 2016 Altogether, accounting for both the TARP and the Fannie and Freddie bailout, $619B has gone out the door—invested, loaned, or paid out—while $390B has been returned. The Treasury has been earning a return on most of the money invested or loaned. So far, it has earned $298B. […]

Tips To Consider Before You Leave Your Child An Inheritance

Doug and Tammie share an article from Forbes.com on things to consider before you leave an inheritance to your children. Warren Buffett enrolled Bill Gates in not leaving all his money to his children. “I’ve given them enough that they can do anything with their lives, but not enough that they can do nothing.” Warren Buffett […]

Is Your Child Headed Toward Financial Disaster?

It’s impossible to know the future and it’s unfair to your kids, who may well surprise you in their financial future to take any of the following red flags too seriously. In saying that some of these red flags are worth paying attention to and possibly changing some of your habits to instill new ones […]

Social Security Status And Possible Fixes

SOCIAL SECURITY STATUS Not much has changed in the financial status of the Social Security Trust Funds since last year, according to today’s release of the annual report on the status of the funds by the Social Security Board of Trustees. The combined asset reserves of the Old-Age and Survivors Insurance, and Disability Insurance (OASDI) […]

Testimonial To Doug Haldeman & Cornerstone Mortgage, Inc

Testimonial From First Time Home Buyer A testimonial from clients are the greatest reward given to any loan officer. Client Mike offers a viewpoint that many other first time home buyers may be faced with and how much Doug Haldeman was able to help him through his […]

Success Clues

Success Clues What does success look like to you? This may be a difficult question to answer for most, however with a little focus the answer can be found. For some success means a new house or car, but for others it means the ability to spend more time with family or friends. However, one […]

Market Update: No Fed Rate Hike & Brexit

Market Update: No Fed Rate Hike & Brexit Brexit Britain will decide, via a referendum, whether to stay in the European Union(EU) or not on Thursday, June 23. The British exit or “Brexit” as it’s known could have major economic impacts on the U.S. as well as the EU. No country has ever left the EU […]

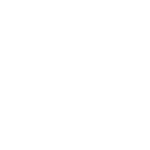

Average Credit Card Debt in America

Average Credit Card Debt in America Our researchers found the median debt per American household to be $2,300, while the average credit card debt stands at $5,700. Combined data from the U.S. Census Bureau and the Federal Reserve allowed us to dive deeper into credit card debt in the United States, and look beyond the […]

Escrow or Not To Escrow

Escrow Accounts Homebuyers typically pay extra money into escrow accounts every month, along with their home loan payments. It’s kind of like having your mom or dad hold on to your money when you were a kid while you went and played. Escrow accounts can take the pain of losing your money or not being […]