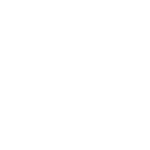

Average Credit Card Debt in America Our researchers found the median debt per American household to be $2,300, while the average credit card debt stands at $5,700. Combined data from the U.S. Census Bureau and the Federal Reserve allowed us to dive deeper into credit card debt in the United States, and look beyond the […]

Resources

Real Estate Industry Acronyms and Abbreviations

Real Estate Industry Acronyms and Abbreviations Within the real estate industry your realtor uses abbreviations and acronyms are often in everyday language. While these terms may seem familiar, their actual meaning may be confusing or different than expected. We have listed some common terms in the industry and explained what they mean. ABR® (The Accredited Buyer’s Representative) […]

Property Rehab 101

Property Rehab When buying property for rehablilitation, it is really important to do your house clean-up and repairs in proper order. You don’t want to get ahead of yourself or waste time and money having to do things twice. Approach the rehab process systematically and do not frustrated if everything does not go according to […]

Identity Theft: Stolen Identity Refund Fraud

Identity Theft is no fun to have to go through and having your identity stolen is unfortunately becoming common place these days. In the movies we would watch a person meeting Guido in the back alley or the characters in the movies were placed in the witness protection program with a new identity. Maybe you were […]

Market Cycles with John Sprague

“If you’re not concerned about the market, you’re not paying attention!” – Gary Keller Join Doug Haldeman and John Sprague as they discuss the market cycles and how it may effect you. Through a deep, rich understanding of the market cycles you will be able to best position yourself to take advantage of another great […]

Inquiries: Losing Points On Your Credit Score

How many points does a credit inquiry make you lose? You all know this person, and if you don’t it’s probably because it’s you. The person who opens up their wallet or purse to see every store credit card that is known to man/woman. This is all due to that delightful store clerk asking them […]

How To Choose Which Debts To Pay Off First

Even most experts make the wrong choices when choosing which debts to pay off first. For an example if you received $30,000 and you are faced with the decision on what debt to pay first will you make the right choice? Andy Prescott from the artofbeingcheap.com approached this topic. Check out his post at: The […]

Rethinking Your Resolutions

New year, new you, new home. The calendar change always invites all sorts of resolutions, some of them attainable, many of them impractical and stress-inducing. But changes needn’t be big or difficult to be life-altering. Here are some financial–related New Year’s resolutions you can make for 2016 that will pay big dividends with minimal effort.

Investing In Real Estate As A Couple: Part 1

Real estate investing is not a “get rich quick” scheme. Just as any home needs a solid foundation so does your real estate education. This is key to your long term investing success. First ask yourself a few questions: Do we have a clear understanding of what type of real estate properties are best suited […]

Negotiation Strategies with Merle Schneider

Merle Schneider, Co- Owner Broker with Schneider Real Estate, joins Doug and Tammie to talk about the negotiation strategies in work and in personal life. As we may already know conflict adds to one’s tensions and anxiety. It is better to discuss things and reach to an alternative benefitting all. Issues must not be dragged unnecessarily […]