Getting a Home Loan: What You Need to Know About Your Interest Rate Interest rates are often a big part of the conversation when you are getting a home loan. Most people want to secure the lowest rate possible while still maintaining low fees and […]

Mortgage

Renovation Loans: Finance Your Dream Home

Finance Your Dream Home with One Loan Have you thought about buying a “fixer-upper”, but you’re not sure where to get the money for renovations? Maybe you have the money to renovate, but the thought of losing that much liquidity scares you. Perhaps, you have been in your home […]

6 Reasons to Refinance: How To Take Advantage of Appreciation and Low Rates

6 Reasons to Refinance You may find that refinancing could save tens of thousands of dollars in interest and years of mortgage debt repayment. It does take some effort to get the process started. However, the time and effort spent could easily be worth it depending on your situation. Here are 6 reasons to refinance, […]

6 Crucial Questions To Plan Your Mortgage

Loan Officer or Debt Strategist? In your last mortgage transaction were you working with a true mortgage professional? I believe that a true mortgage professional should be more than a Loan Officer, they should be your Debt Strategist. Many people have professionals managing all other parts of their financial […]

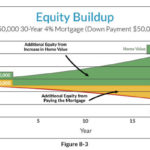

11 Reasons to Carry a Big, Long Mortgage by Ric Edelman

The Truth About Money You may have heard that it’s best to have the smallest mortgage you can and to pay it off as quickly as possible. Or perhaps you have heard to save up as much money as you can to throw it all at your […]

How To Choose A Mortgage Lender with Nathan Grojean

Choosing a Mortgage Lender Buying a home is likely one of the biggest purchases you will ever make. You wouldn’t trust your car with just any mechanic, so why would you trust your home loan with just anyone who came up on an internet search? Choosing a mortgage lender is as big a part of […]

Strategies To Buy and Sell a Home At The Same Time

Unless you are one of the rare homeowners with the financial ability to pay two mortgages at once, buying a home before selling your current home is not really an option. Given the fact you need to sell your current home to pay for a new one, you will need to prepare yourself for a certain level of uncertainty.

How To Qualify For A Mortgage When You’re Self-Employed

It’s one of the American dreams to own your own business and work for yourself. There are many benefits that come with being your own boss, however there are some negatives as well. Being self-employed comes with its own set of difficulties, and qualifying for a mortgage can be one of them. I wanted to outline some of the things lenders look at when you’re self-employed, and what to expect when going through the process.

8 Steps to Take Before Buying Your First Home

It’s likely that buying your first home will be the biggest purchase of your life so far. Going from renting or living with family to being a homeowner is a big transition, and the process can be a little intimidating. You will no longer have a landlord to call on when something breaks, but homeownership is one of the largest vehicles for generating wealth. Let’s take a look at the 8 steps to take before buying your first home.

HomeScout: Try the Newest Real Estate App!

If you are like most people, your home search begins online. Home Scout is the newest real estate app, it is invite only, and we wanted to offer you the chance to test it out!