Credit Score Basics A credit score is based on the information drawn from your credit report and there are many different individual factors that are used to determine your score. Doug and Tammie go over some of these factors to help breakdown what your score is telling creditors. What makes up your credit score? Payment History: […]

Financial Advisor

The Waiting Period After Foreclosure, Bankruptcy, or Short Sale

If you have lost your home through a foreclosure, short sale or bankruptcy and want to get another mortgage loan, you may be wondering how long you’ll have to wait. Your credit will take a hit after all of these situations, although possibly not as much as you think or for as long as you […]

8 Financial Tips For Young Adults

Personal finance has not yet become a required subject in high school or college. If it is available for you to take in your school, will you apply what you learn? You may be more focused on relationships, video games, the newest fad, partying and not quite understand how decisions you make today financially […]

Inquiries: Losing Points On Your Credit Score

How many points does a credit inquiry make you lose? You all know this person, and if you don’t it’s probably because it’s you. The person who opens up their wallet or purse to see every store credit card that is known to man/woman. This is all due to that delightful store clerk asking them […]

Rethinking Your Resolutions

New year, new you, new home. The calendar change always invites all sorts of resolutions, some of them attainable, many of them impractical and stress-inducing. But changes needn’t be big or difficult to be life-altering. Here are some financial–related New Year’s resolutions you can make for 2016 that will pay big dividends with minimal effort.

Investing In Real Estate As A Couple: Part 1

Real estate investing is not a “get rich quick” scheme. Just as any home needs a solid foundation so does your real estate education. This is key to your long term investing success. First ask yourself a few questions: Do we have a clear understanding of what type of real estate properties are best suited […]

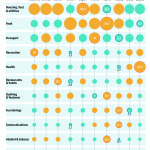

Peaking Into the Wallet Of Some Countries Spending Habits

Doug and Tammie discuss how some countries are spending their money and where the US compares as a whole. Though the chart, created by the Data Team with The Economist, may be lacking in how countries are taxed or not taxed it is an interesting glimpse into the wallet of a few of the countries […]

Financial Baggage Part 2: Millionaire Myths

Here are seven millionaire myths*, and the real facts about the ones who seem to have it all. Millionaires Don’t Pay Their Taxes Fact: It is estimated that millionaires, those in the top 1% of earners, pay about 40% of all taxes. Current tax regulation shifts may change these numbers to make this even larger […]

Money Mentality: What is your financial baggage?

Remember the show Money Pit? Did the Fielding’s aka Tom Hanks and Shelly Long carry forward their money baggage from their past? Have you ever wanted something so bad you are willing to believe the con? Doug and Tammie are joined by their son Derek to discuss what financial baggage people carry around. The discussion challenges […]

Survival At Home: 45 Ways To Save Money

Doug and Tammie share a greate article from Survival at Home. It’s no secret that life is expensive. The bad news is, it gets more expensive every year. Inflation drives up the cost of living, gas prices go up year after year, and the older your kids get, the more they eat (so learn to save […]