Focus on Fundamentals

One of the things I’m not sure I’ve had the opportunity to share is my purpose for creating the show. Creating Smart With Your Money came about as a way for me to share the information I’ve learned throughout my life with other people. Through the years I’ve come up with 7 main fundamental financial principles that I think you’ll get good use out of.

My Purpose

I grew up very poor, living in a trailer, in southern Missouri. My father was a veteran who lived about 2 hours away. Therefore, I only got to see him once a month and as a child I really treasured these times. When I was speaking with him once he mentioned in passing that he didn’t know how he would keep the lights on that month. Even though he didn’t mean to, this really upset me. It hurt me so much that I cried myself to sleep for nearly an entire month until I saw him again.

During that time, while thinking about his situation, I vowed that I would never find myself in a financial spot where keeping the lights on would be an issue. Now, where I grew up we weren’t the only poor family. In fact, nearly everyone around me was poor. Most people were just trying to get by and had no idea about financial freedom. For them it wasn’t even a possibility.

Having no one near me to teach me I had to seek out the knowledge. I read countless books on financial subjects and sought out mentors to teach and guide me. This effort has put me where I am today; now I have the opportunity to share with others all that I’ve learned over the years.

The next section will go into some of the fundamental financial principles that have helped me the most over the years. While many of these are not ground-breaking ideas, they will lay the foundation for your financial future.

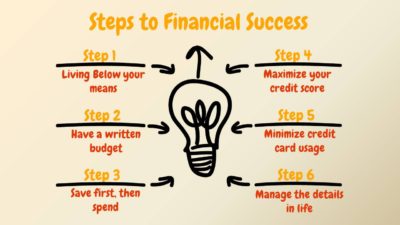

The Fundamentals

1. Living Below your Means

Many of us are guilty of “keeping up with the Joneses”, but this can be a very scary trap to fall into. You always want to spend less money than you earn. Tracking your income versus your expenses starts by creating a budget. My best advice is to look back at your last 6 months of spending. Pull up your bank account online or print it out and begin to categorize your spending. This way you’ll be able to see exactly how you spent on groceries, eating out, gas, etc.

2. Save First, Spend What’s Left

While this may seem like semantics, what it actually means is everyone should be saving a certain percent of their income automatically. Regardless of income level everyone is capable of saving a certain amount. Whether this is a 401k, ideal if employer matched, or just depositing to an emergency fund.

3. Manage the Details in Life

Good examples of this include overdraft fees or signing up for a free trial that then begins to charge after the trial expires. Managing these small details can save you a lot in the long run.

4. Maximize your Credit Score

Unfortunately, in today’s society credit is a game that you have to play. Remember, however, that it is just a game. Learning how to play this game properly can save you thousands of dollars over your lifetime. I’ve talked about credit numerous times in the past. So if you haven’t done so yet check out some of my tips on this.

5. Minimize your Credit Card Usage

While I encourage the use of credit cards to build credit scores, do not use them frivolously. I advocate the use of credit cards only if there is a good rewards program attached. However, having said that be sure that you can pay the balance off each month before you start getting hit with finance charges.

6.Plug the Leaks

This means stopping the waste of money. Whether this waste comes from late fees, finance charges, or overdraft protection to name a few. I like the idea of there being some emotional pain involved each time this happens. This will help you avoid those charges in the future.

7. Avoid Recurring Expenses & “Free” Trials

Anything that becomes a bill for me I like to avoid. I don’t need any extra bills each month. If this means cutting out cable or even cell phones for a lot of people. I would urge you to avoid always upgrading to every new phone that comes out. There are numerous other ways to get that phone and they are most likely cheaper in the long run. This also goes into “free” trials which usually become a recurring expense after the trial ends. It’s easy to let small things like this fall through the cracks.

Thanks for reading and I hope you’ll be able to take some of these fundamentals with you and make them a part of your financial playbook. If you need help or just have some questions be sure to subscribe to Smart With Your Money!

Listen to the Audio Below!

Podcast: Play in new window | Download

[…] also will want to follow the principles of Paying Yourself First, and creating an Emergency Fund. Some of these strategies will assume you have an emergency fund […]