Advertising will often make consumers believe that they can walk into their local bank or call an online lender to get a mortgage. This may be fine as long as your situation is simple. However, a large percentage of mortgage applicants have situations that make them unique. Mortgage guidelines change very rapidly. There are tax […]

Personal Finance

Inquiries: Losing Points On Your Credit Score

How many points does a credit inquiry make you lose? You all know this person, and if you don’t it’s probably because it’s you. The person who opens up their wallet or purse to see every store credit card that is known to man/woman. This is all due to that delightful store clerk asking them […]

How To Choose Which Debts To Pay Off First

Even most experts make the wrong choices when choosing which debts to pay off first. For an example if you received $30,000 and you are faced with the decision on what debt to pay first will you make the right choice? Andy Prescott from the artofbeingcheap.com approached this topic. Check out his post at: The […]

Rethinking Your Resolutions

New year, new you, new home. The calendar change always invites all sorts of resolutions, some of them attainable, many of them impractical and stress-inducing. But changes needn’t be big or difficult to be life-altering. Here are some financial–related New Year’s resolutions you can make for 2016 that will pay big dividends with minimal effort.

Investing In Real Estate As A Couple: Part 1

Real estate investing is not a “get rich quick” scheme. Just as any home needs a solid foundation so does your real estate education. This is key to your long term investing success. First ask yourself a few questions: Do we have a clear understanding of what type of real estate properties are best suited […]

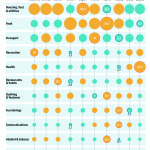

Peaking Into the Wallet Of Some Countries Spending Habits

Doug and Tammie discuss how some countries are spending their money and where the US compares as a whole. Though the chart, created by the Data Team with The Economist, may be lacking in how countries are taxed or not taxed it is an interesting glimpse into the wallet of a few of the countries […]

How much did Clark Griswold spend on Christmas lights!

Image credit: Warner Brothers Thanks to our friend Andy Prescott for doing all the research on this subject! http://artofbeingcheap.com/christmas-lights/ Griswold Christmas Lights Audio: Segment 1

Financial Baggage Part 2: Millionaire Myths

Here are seven millionaire myths*, and the real facts about the ones who seem to have it all. Millionaires Don’t Pay Their Taxes Fact: It is estimated that millionaires, those in the top 1% of earners, pay about 40% of all taxes. Current tax regulation shifts may change these numbers to make this even larger […]

Money Mentality: What is your financial baggage?

Remember the show Money Pit? Did the Fielding’s aka Tom Hanks and Shelly Long carry forward their money baggage from their past? Have you ever wanted something so bad you are willing to believe the con? Doug and Tammie are joined by their son Derek to discuss what financial baggage people carry around. The discussion challenges […]

Commercial Real Estate with Greg Schowe

Born and raised on the family farm in east central Missouri, Greg knew at an early age the definition of hard work and an honest living. After high school Greg applied the traits learned on the farm and enlisted in the U.S. Navy for 6 ½ years. After military life Greg decided to pursue the […]