Closing the Gap Between your Financial Reality and Goals Most of us are failing miserably with our finances. Personal savings rates are at an all time low, retirements savings are non-existent, and overall net worth is diminishing. Nobody wants to be terrible with their finances, so why are we failing? We’ll take a […]

Personal Finance

How Much Is Enough? & The Law of Diminishing Returns

We have the ability to recognize when something benefits us, but at what point does the benefit begin to decrease? Our brains have an amazing capacity to recognize value and encourage us to repeat those behaviors or actions that created that value. The Law of Diminishing Returns is always in effect, but we just may not notice it. The problem lies in the fact that we don’t have a shut-off for this reward seeking behavior. Our brains don’t naturally recognize abundance, and the same desire exists for more, more, more.

Budgeting Made Easy

Building a budget may sound complicated, but it is an essential Fundamental Financial Principle. If used properly, budgeting will prevent costly mistakes, increase savings, avoid unnecessary expenses, and improve your overall financial health. I wanted to come up with a foolproof system for creating a budget that works and one that is easy.

Streamline Your Finances: 5 Phases

Dealing with bills, documents, and how your money comes in and out can be a complicated process. However, I believe the task can be simplified. I want to share with you my methodology to streamline your finances. There was a time when I would spend 8 hours EACH month working on my finances. Now, I have it down to about 30 minutes. Read on to find out how I was able to do this.

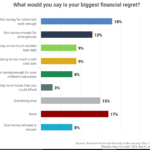

Biggest Financial Regrets

It’s hard to get through life without at least one major financial regret. That’s the conclusion from a new Bankrate nationwide survey that finds only 17% of Americans say they have no money decisions they’d want to take back.

4 Consumer Loans That Affect How Much Home You Can Buy

4 Consumer Loans When you are looking at buying a home your lender will evaluate your debt and credit score. These have a big impact on whether your loan will be approved, and how much you can afford. We are going to outline 4 consumer loans that could make or break your mortgage […]

Fundamental Financial Principles

Focus on Fundamentals One of the things I’m not sure I’ve had the opportunity to share is my purpose for creating the show. Creating Smart With Your Money came about as a way for me to share the information I’ve learned throughout my life with other people. Through the years I’ve […]

Being Smart With Your Money as a College Graduate: 10 Tips

Being Smart With Your Money as a College Graduate: 10 Tips It’s the time of year where many people will graduating college and going into the “real” world. The party is winding down and reality will be setting in. College is not the easiest place to learn about finances. You’re taking on debt while not bringing […]

The Waiting Period After Foreclosure, Bankruptcy, or Short Sale

If you have lost your home through a foreclosure, short sale or bankruptcy and want to get another mortgage loan, you may be wondering how long you’ll have to wait. Your credit will take a hit after all of these situations, although possibly not as much as you think or for as long as you […]

Be On A Budget And Still Go Out With Your Friends

You and your friends may have shared a similar economic situation when you were kids or while you were in college, but now that you are adults, your incomes might diverge widely. Differences in spending habits can destroy a friendship when they result in wildly different lifestyles or feelings of resentment, but if you approach […]