If you have lost your home through a foreclosure, short sale or bankruptcy and want to get another mortgage loan, you may be wondering how long you’ll have to wait. Your credit will take a hit after all of these situations, although possibly not as much as you think or for as long as you […]

8 Financial Tips For Young Adults

Personal finance has not yet become a required subject in high school or college. If it is available for you to take in your school, will you apply what you learn? You may be more focused on relationships, video games, the newest fad, partying and not quite understand how decisions you make today financially […]

7 Lies Young People Hear When Growing Up

So you have a few of the ‘certificate of participation’ awards and want to take those to your first job interview, well you will soon see how much weight they carry. The ‘Wall of Gaylord Focker’ may need to stay on the wall of your parents home.” The truth? Honesty is a must, perfection is a myth, and failure is […]

Why You Need a True Mortgage PRO!

Advertising will often make consumers believe that they can walk into their local bank or call an online lender to get a mortgage. This may be fine as long as your situation is simple. However, a large percentage of mortgage applicants have situations that make them unique. Mortgage guidelines change very rapidly. There are tax […]

Inquiries: Losing Points On Your Credit Score

How many points does a credit inquiry make you lose? You all know this person, and if you don’t it’s probably because it’s you. The person who opens up their wallet or purse to see every store credit card that is known to man/woman. This is all due to that delightful store clerk asking them […]

How To Choose Which Debts To Pay Off First

Even most experts make the wrong choices when choosing which debts to pay off first. For an example if you received $30,000 and you are faced with the decision on what debt to pay first will you make the right choice? Andy Prescott from the artofbeingcheap.com approached this topic. Check out his post at: The […]

Rethinking Your Resolutions

New year, new you, new home. The calendar change always invites all sorts of resolutions, some of them attainable, many of them impractical and stress-inducing. But changes needn’t be big or difficult to be life-altering. Here are some financial–related New Year’s resolutions you can make for 2016 that will pay big dividends with minimal effort.

The Art and Science of Connection

By Jo Rossi and Kavin Chambers We had the pleasure of being guests on the Doug Haldeman radio show to discuss our upcoming course, The Art and Science of Connection: Fostering an Authentic Relationship (ASC). Connection is a concept that is difficult to define definitively because it is absolutely subjective. What connection means for me […]

Investing In Real Estate As A Couple: Part 1

Real estate investing is not a “get rich quick” scheme. Just as any home needs a solid foundation so does your real estate education. This is key to your long term investing success. First ask yourself a few questions: Do we have a clear understanding of what type of real estate properties are best suited […]

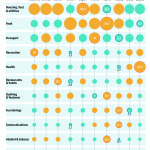

Peaking Into the Wallet Of Some Countries Spending Habits

Doug and Tammie discuss how some countries are spending their money and where the US compares as a whole. Though the chart, created by the Data Team with The Economist, may be lacking in how countries are taxed or not taxed it is an interesting glimpse into the wallet of a few of the countries […]