Two St Louis Areas were the most profitable zips in the U.S. for flipping property in 4th quarter

Two zip codes in the city of St Louis made RealtyTrac’s list of “Zips with the highest gross returns (from flipping property)” for 4th quarter, 2014. The 63139 zip code, which includes the Dog Town area of St Louis, came in number 2 on the list with an average gross return on investment of 163.9% and the 63116 zip code, which includes Tower Grove South, Holly Hills, Dutchtown South and Bevo, came in 9th on the list with an average gross return on investment of 127.7%.

To be eligible to be considered for the list, there had to be at least 10 single family homes “flips” completed during the 4th quarter of 2014. In the 63139 area of St Louis, there were 18 such home flips during the quarter with an average purchase price of $9,000 and an average gross profit of $14,750 from the flip. In the 63116 zip area, there were 21 flips during the quarter with an average purchase price of $27,721 and an average gross profit of $35,407. The table below shows the data for all 10 top gross returns from flipping property zips in the U.S.

Zip Codes with the highest gross returns from flipping property – 4th Quarter 2014

| Zip Code | City | MSA | Q4 2014 Home Flips |

Pct of Total Sales |

YoY Pct Change |

Avg Purchase Price |

Avg Gross ROI |

Flipping Avg Gross Profit |

| 21218 | Baltimore | Baltimore-Towson, MD | 14 | 11.0% | 2.0% | $51,233 | 208.6% | $106,847 |

| 63139 | Saint Louis | St. Louis, MO-IL | 18 | 14.0% | -9.3% | $9,000 | 163.9% | $14,750 |

| 32205 | Jacksonville | Jacksonville, FL | 19 | 13.8% | -10.5% | $52,216 | 157.0% | $81,962 |

| 60643 | Chicago | Chicago-Naperville-Joliet, IL-IN-WI | 12 | 11.8% | 31.8% | $150,750 | 153.7% | $231,750 |

| 60402 | Berwyn | Chicago-Naperville-Joliet, IL-IN-WI | 20 | 11.5% | 0.1% | $93,000 | 149.7% | $139,222 |

| 21207 | Gwynn Oak | Baltimore-Towson, MD | 20 | 13.2% | -29.4% | $76,275 | 149.7% | $114,168 |

| 48220 | Ferndale | Detroit-Warren-Livonia, MI | 12 | 6.7% | 54.1% | $70,200 | 141.5% | $99,300 |

| 21213 | Baltimore | Baltimore-Towson, MD | 11 | 6.7% | 19.2% | $39,180 | 137.9% | $54,020 |

| 63116 | Saint Louis | St. Louis, MO-IL | 21 | 13.3% | -10.4% | $27,721 | 127.7% | $35,407 |

| 20743 | Capitol Heights | Washington-Arlington-Alexandria, DC-VA-MD-WV | 22 | 19.5% | -18.9% | $97,371 | 119.9% | $116,764 |

Averages from these top 10 zip codes for biggest average percentage return on flips:

- Average of 17 flips during the fourth quarter

- Average flip share of 12 percent of all single family home sales

- Average increase of 3 percent in share of flips from a year ago

- Average purchase price of $66,695

- Average gross profit of $99,419 and average gross return of 150.9 percent

Posted by: Dennis Norman on St. Louis Real Estate News

Property Flipping Drops To Four-Year Low in Q4

RealtyTrac has released its Q4 and Year-End 2014 U.S. Home Flipping Report, which shows that 136,269 U.S. single family homes were flipped in 2014, 5.4 percent of all single family home sales during the year—the lowest share of flips since 2011. A total of 32,578 U.S. single family homes were flipped in the fourth quarter, representing 5.3 percent of all single family home sales during the quarter. The 5.3 percent share of flips in the fourth quarter was up 11 percent from the previous quarter but still down 12 percent from a year ago.

The average gross profit—the difference between the purchase price and flipped price—for completed flips of single family homes in the fourth quarter was $65,993, representing a 37.1 percent gross return. That was up from an average gross profit of $65,285 representing a 36.5 percent gross return in the third quarter, and an average gross profit of $63,017 representing a 36.4 percent gross return in the fourth quarter of 2013.

“Investors have picked much of the low-hanging fruit when it comes to home flipping over the past three years since home prices bottomed out in the first quarter of 2012,” said Daren Blomquist, vice president at RealtyTrac. “As home price appreciation slows to single digits in most markets, flippers need to be more selective and creative about the properties and neighborhoods they target. In many cases the best neighborhoods for profitable flipping in a slower-appreciating market are those that come with a higher risk because of location and condition of properties, but also have a bigger upside if investors are able to correctly predict the path of progress in the region. It appears that most investors completing flips in the fourth quarter were able to do just that. Even though the share of flips was down from a year ago during the quarter, the average gross return per flip increase

For more information about flipping property visit the National Mortgage Professional

Inventory of Homes For Sale In St. Louis At 10 Year Low

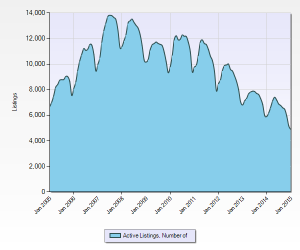

As of the end of last month, there were 4,873 active listings of homes and condos for sale in the counties of St Louis and St Charles, the lowest inventory of homes for sale for those two counties in over 10 years. As the 10-year chart below shows, the inventory peaked at 13, 823 active listings in July 0f 2007 so the inventory of homes for sale in St Louis & St Charles County has fallen almost 65% since hitting the peak during 2007.

It’s no wonder we are seeing many homes selling within days of hitting the market, and, often at or above full asking price. Of course, as I have said before, home buyers today are pretty savvy so they are not jumping at overpriced listings but if they are priced appropriately and properly marketed, they are gone quick!

Posted by: Dennis Norman on St. Louis Real Estate News

Podcast: Play in new window | Download