Finance Your Dream Home with One Loan

Have you thought about buying a “fixer-upper”, but you’re not sure where to get the money for renovations? Maybe you have the money to renovate, but the thought of losing that much liquidity scares you. Perhaps, you have been in your home for a while and have thought about doing some repairs, you are just not sure how to get them done. Well, a renovation loan might be right for you. With these products you can purchase a home, and finance in the repairs. Or, if you already own a home, you can refinance your current mortgage and finance in home improvements.

These loans are perfect for a first time home-buyer, someone who is ready to move up, or even someone looking to break into property investing. There are several different options depending on your exact scenario, and we will cover a few of them here. To learn more and find out if this is the right option for you either fill out a contact form here or reach out to us at (314) 472-DOUG (3684).

What are Renovation Loans?

Renovation loans allow you get one loan for both the cost to purchase a home plus the repair costs or to refinance your current mortgage plus repair costs. This opens up a lot of options for people looking to purchase a new home, or to finally get that home improvement project done that you’ve been wanting to do.

203k or HomeStyle

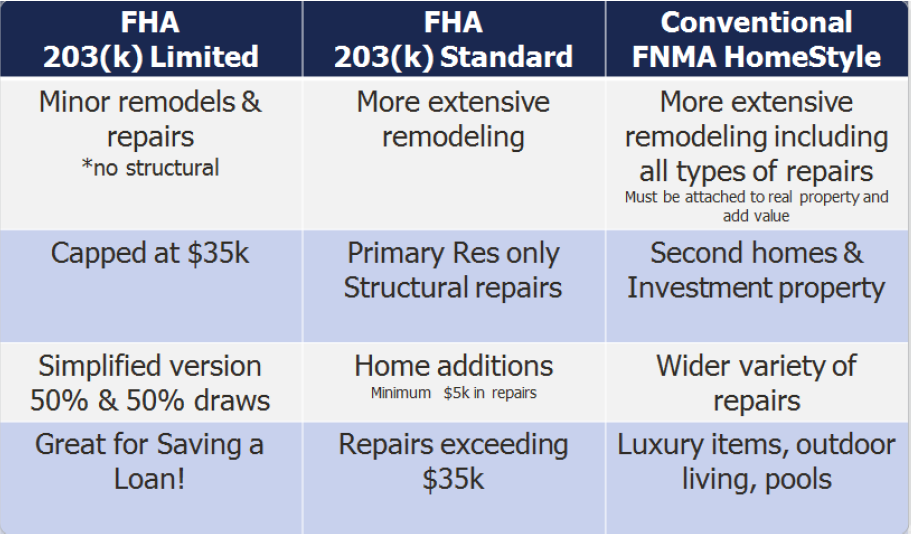

There are four options when considering a renovation loan: FHA 203k Standard, 203k Limited, HomeStyle Standard, & HomeStyle Limited. The option you end up with will depend on the size and scale of your project, and the type of property you are looking to rehab.

203k

This is an FHA loan, guaranteed by HUD. These allow for as little as 3.5% down on owner occupied primary residences. The Limited allows for repairs up to $35,000 and is a little simpler, but only allows certain repairs. The Standard has a minimum of $5000 in repairs, but no maximum amount as long as the loan amount doesn’t exceed the county loan limits.

HomeStyle

This loan allows for luxury items like a pool or outdoor BBQ area. The loan limits are higher, and generally speaking is a little looser in allowable repairs than a 203k. This also allows for repairs on Vacation homes, and Investment properties!

Check out these charts to help find the option for you

This is just an overview of the options, for more details reach out today by filling out a contact form here or by calling/texting (314) 472-DOUG (3684)

Podcast: Play in new window | Download