Average Credit Card Debt in America

Our researchers found the median debt per American household to be $2,300, while the average credit card debt stands at $5,700. Combined data from the U.S. Census Bureau and the Federal Reserve allowed us to dive deeper into credit card debt in the United States, and look beyond the face value of those two figures. Below you’ll find some of the most prominent trends that emerged from the available data.

American Credit Card Debt Statistics & Key Findings – Updated May 2016

- Average American Household Debt: $5,700. Average for balance-carrying households: $16,048

- Total Outstanding U.S. Consumer Debt: $3.4 trillion. Total revolving debt: $929 billion

- 38.1% of all households carry some sort of credit card debt.

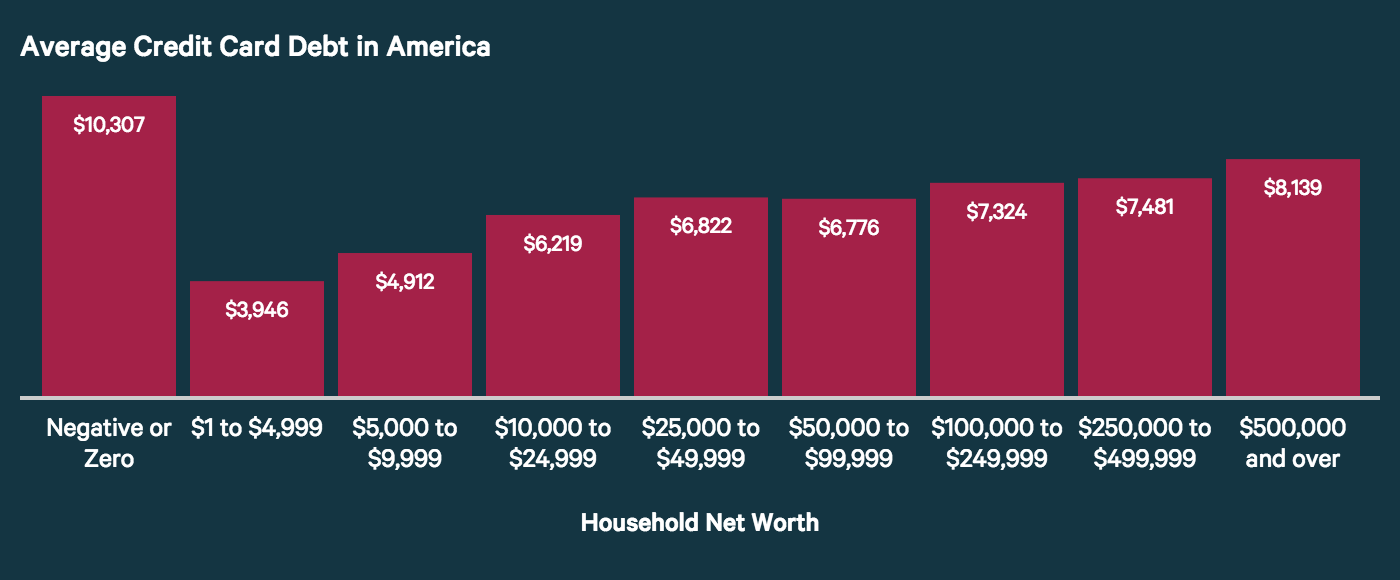

- Households with the lowest net worth (zero or negative) hold an average of $10,308 in credit card debt.

- The Northeast and West Coast hold the highest average credit card debt – both averaging over $8,000.

Average Credit Card Debt in America

The mean credit card debt of U.S. households is approximately $5,700, according to most recent data from the Survey of Consumer Finances by the U.S. Federal Reserve. This information comes from data collected up through to the year 2013, and represents the most reliable measure of credit card indebtedness in the United States. The “mean amount of credit card debt” considers balances that Americans above the age of 18 have on average, throughout the year.

Credit Card Debt Audio 1

Credit Card Debt Audio 2

Another method for estimating average credit card debt is to look only at indebted households – excluding who pay their balances in full on a monthly basis. To obtain this figure, we looked at data reported by the Federal Reserve for Outstanding Revolving Debt – we then divided that number by the number of card-carrying households each year. As of March 2016, the average credit card debt for these households is $16,048.

| Period | Outstanding Revolving Debt (Billions) | Estimated Total Outstanding Credit Card Debt (Billions) | Avg. Indebted Household Credit Card Debt | Percent Change in Average Debt |

| 2010 | $841 | $673 | $15,024 | -3.51% |

| 2011 | $843 | $674 | $14,915 | -0.73% |

| 2012 | $846 | $677 | $14,671 | -1.63% |

| 2013 | $852 | $682 | $14,609 | -0.43% |

| 2014 | $890 | $712 | $15,165 | +3.81% |

| Q1’15 | $891 | $713 | $15,020 | -0.95% |

| Q2’15 | $910 | $728 | $15,336 | +2.10% |

| Q3’15 | $923 | $738 | $15,547 | +1.37% |

| Oct. 2015 | $924 | $739 | $15,568 | +0.14% |

| Nov. 2015 | $929 | $743 | $15,652 | +0.54% |

| Dec. 2015 | $936 | $749 | $15,779 | +0.81% |

| Jan. 2016 | $938 | $751 | $15,812 | +0.21% |

| Feb. 2016 | $941 | $753 | $15,863 | +0.32% |

| Mar. 2016 | $952 | $762 | $16,048 | +1.16% |

During the course of our study on average credit card debt, we observed some significant differences among different demographics and regions. The most prominent differences exist among peoples of different race, age, gender, and state of residence. In the following sections we explore these differences to see how average credit card debt varies among the population.

Average Credit Card Debt by Region

Average credit card debt varied widely by state or region. According to data from the credit reporting agency TransUnion, the typical Alaska residents carried the most credit card debt – an average of $6,910 – this is 23% more than Colorado, which is the next state carrying the highest average credit card debt.

The average householder in Iowa holds just $3,885 in credit card debt, which is almost half as much as the rest of the nation. North and South Dakota, and Nebraska were among other states which came in with low average credit card debt per household – the three held an average of $4,182.

To see the average credit card debt throughout the nation, use the interactive map below. Hover over a state in order to display its average. Light blue states have lower debt, while dark blue states have higher levels of credit card debt.

Average Credit Card Debt Throughout the United States

| State | Average Credit Card Debt |

| Alaska | $7,706 |

| District of Columbia | $6,580 |

| Virginia | $6,520 |

| Connecticut | $6,494 |

| Maryland | $6,448 |

| New York | $6,390 |

| Colorado | $6,323 |

| Washington | $6,241 |

| Hawaii | $6,139 |

| Delaware | $6,056 |

| New Jersey | $6,013 |

| Texas | $5,960 |

| New Hampshire | $5,939 |

| Illinois | $5,935 |

| Georgia | $5,800 |

| Vermont | $5,781 |

| California | $5,769 |

| Oregon | $5,769 |

| Florida | $5,754 |

| Oklahoma | $5,728 |

| Wyoming | $5,716 |

| Nevada | $5,715 |

| Arizona | $5,673 |

| Massachusetts | $5,672 |

| South,Carolina | $5,653 |

| Kansas | $5,647 |

| Pennsylvania | $5,646 |

| North Carolina | $5,596 |

| Ohio | $5,583 |

| Minnesota | $5,565 |

| Idaho | $5,555 |

| Alabama | $5,548 |

| Utah | $5,532 |

| New Mexico | $5,514 |

| Tennessee | $5,492 |

| Rhode Island | $5,455 |

| Missouri | $5,431 |

| Louisiana | $5,408 |

| Arkansas | $5,317 |

| Indiana | $5,288 |

| Montana | $5,283 |

| Mississippi | $5,198 |

| Wisconsin | $5,142 |

| West Virginia | $5,123 |

| Michigan | $5,079 |

| Kentucky | $5,070 |

| Maine | $5,059 |

| North Dakota | $4,932 |

| South Dakota | $4,851 |

| Nebraska | $4,833 |

| Iowa | $4,734 |

Average Credit Card Debt by Age

Credit card debt appears to peak for individuals who are between 45 and 54 years old – $9,096. Some of our surveys have shown that this group tends to be among the largest credit card spenders – likely due to the budgets they are operating with. Recent studies have shown this age cohort (commonly referred to as “Baby Boomers”) controls the largest portion of America’s disposable income.

Millennials and individuals over 74 years old held the least credit card debt. These two groups are also among the least likely to have a credit card, which can serve as a potential explanation behind the trend we are seeing here.

| Age | Average Credit Card Debt |

| Less than 35 years | $5,808 |

| 35 to 44 years | $8,235 |

| 45 to 54 years | $9,096 |

| 55 to 64 years | $8,158 |

| 65 years and over | $6,351 |

| 65 to 69 years | $6,876 |

| 70 to 74 years | $6,465 |

| 75 and over | $5,638 |

Average Credit Card Debt by Income

The greater the household income the higher the credit card debt. Individuals in the highest annual income percentile, 90th to 100th, had an average of $11,200 in credit card debt — nearly four times as much as households making the least. However, as a percentage of income, those on the lower end of the spectrum carry more debt.

| Income Range | Income Percentile | Average Credit Card Debt |

| Less Than $24,999 | Less than 20 | $3,000 |

| $25,000 to $44,999 | 20–39.9 | $3,900 |

| $45,000 to $69,999 | 40–59.9 | $4,900 |

| $70,000 to $114,999 | 60–79.9 | $5,800 |

| $115,000 to $159,999 | 80–89.9 | $8,300 |

| $160,000+ | 90–100 | $11,200 |

Average Credit Card Debt by Gender

Male householders carried significantly more credit card debt then their female counterparts. The mean credit card debt held by men is $7,407, whereas women tend to hold 22% less – with an average of $5,245.

Various reports seem to indicate that women prefer the use of debit cards to credit cards. In our recent Survey of Credit Card Consumer Habits, we found that women were more likely to fall into the smaller spending categories, whereas more men tended to be big credit card spenders – 19% of men the men surveyed would spend $2,000+ per month, compared to just 8% of women.

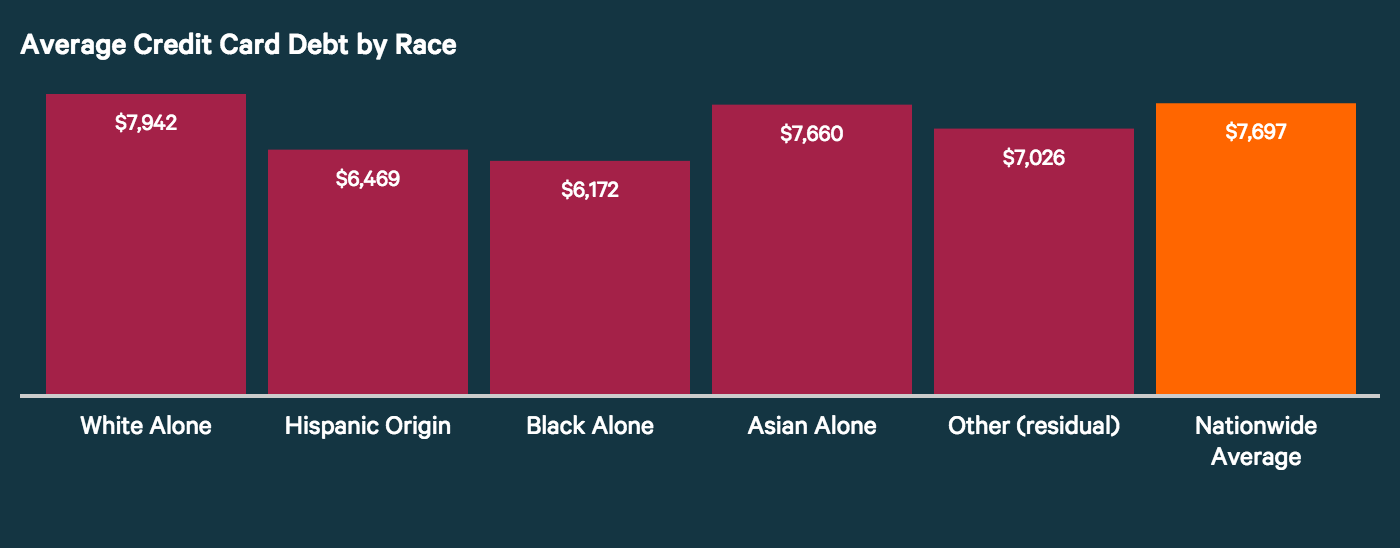

Average Credit Card Debt by Race

Individuals who identified as white (with no Hispanic origin) carried an average of $7,942 in debt – the highest amount of any racial group. They were followed by Asians, with an average credit card debt of $7,660. Black householders carried the least debt, with an average of $6,172, which is 20% lower than the nationwide mean.

Total Credit Card Debt in the United States

Debt arising from credit card use represents less than half of the total average unsecured debt held by Americans. In 2011, the average total unsecured debt was $21,281, and credit cards accounted for just 36% of that figure. For a clearer picture of America’s indebtedness, it is critical to look at total outstanding debts – arising from both credit cards and other sources.

Every month, the Federal Reserve releases statistics regarding total outstanding debts in America – these are referred as “revolving” and “non-revolving” credit. Non-revolving credit refers to loans individuals are paying off over time, while revolving credit refers to an ongoing line of credit extended to a consumer, which they pay off and continually receive. For example, a mortgage is an example of non-revolving credit, since an individual with one will be slowly paying down the debt. Revolving credit is predominantly comprised of credit cards, which users pay down each month, and are immediately given a new line of credit upon payment.

The most recent data indicates that, as of March 2016, the current outstanding revolving debt in the United States is $952 billion. The majority of these debts originate from depository institutions (e.g. banks) – $754.4 billion is owed due to credit extended by these companies. The remainder of the credit debt owed to finance companies and credit unions – $53.5 billion and $48.3 billion respectively.

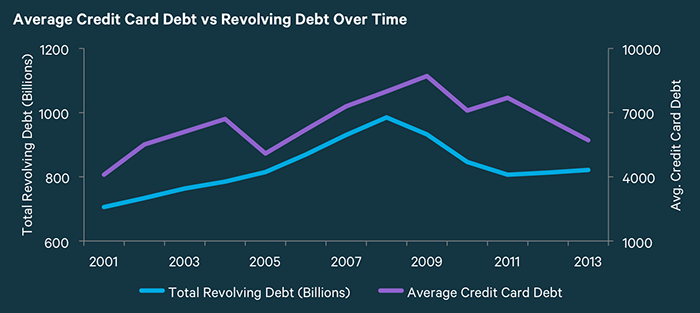

Average credit card debt is closely tied to the total outstanding revolving debt. Over the years, the two have risen together, exhibiting strong correlation (0.6). Over the last decade, average credit card debt has grown at a faster pace – raising by 52% since the year 2000. In that time, outstanding revolving credit has grown with exactly half that rate – increasing 26%.

The above graph presents a single anomaly which occurred in 2005. During that time there was a severe drop in average credit card debt, despite total outstanding revolving debt continuing to rise. This outlier was likely due to the spike in bankruptcy filings in the United States around that time. A law went into effect at the end of 2005 which made it more difficult for individuals to declare bankruptcy. This resulted in a rush of filings before the law’s deadline – over 2 million Americans had their debts forgiven that year due to these filings.

How Has Average Credit Card Debt In America Changed over The Years?

As discussed above, average credit card debt in America has been rising over the last decade. However, despite this, the average percentage of people holding credit card debt has been gradually decreasing. This tells us that the while average credit card debt is increasing, it’s not due to a greater number of individuals spending. Instead, in recent years, more people have been more heavily indebted.

In the year 2000, over half of the households in America had credit card debt. By contrast, in 2001, that figure fell to 38% – over 12 percentage points lower. Over this time, average credit card debt rose from $5,048 to $7,697. This means the average American today holds 52% more debt today than they did a decade ago.

Sources:

2013 Survey of Consumer Finances

From <http://www.valuepenguin.com/average-credit-card-debt>

Credit Card Debt Audio 1

Credit Card Debt Audio 2

Podcast: Play in new window | Download