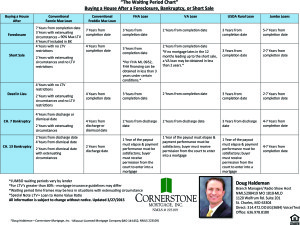

If you have lost your home through a foreclosure, short sale or bankruptcy and want to get another mortgage loan, you may be wondering how long you’ll have to wait. Your credit will take a hit after all of these situations, although possibly not as much as you think or for as long as you may think. Nevertheless, it will likely prevent you from getting another mortgage right away. The amount of time you must wait before applying for a new mortgage loan depends on the type of lender and your financial circumstances.

If you have lost your home through a foreclosure, short sale or bankruptcy and want to get another mortgage loan, you may be wondering how long you’ll have to wait. Your credit will take a hit after all of these situations, although possibly not as much as you think or for as long as you may think. Nevertheless, it will likely prevent you from getting another mortgage right away. The amount of time you must wait before applying for a new mortgage loan depends on the type of lender and your financial circumstances.

2017 FHA GUIDELINES

- Bankruptcy – You may apply for a FHA insured loan after your bankruptcy has been discharged for TWO (2) years with a Chapter 7 Bankruptcy. You may apply for a FHA insured loan after your bankruptcy has been discharged for ONE (1) year with a Chapter 13 Bankruptcy

- Foreclosure – You may apply for a FHA insured loan THREE (3) years after the sale/deed transfer date.

- Short Sale / Deed in Lieu – You may apply for a FHA insured loan THREE (3) years after the sale date of your foreclosure. FHA treats a short sale the same as a Foreclosure for now.

- Credit must be re-established no late payments in past 12-24 months, depending on hardship

Application Date must be after the above waiting period to be eligible for FHA financing after hardship.

2017 VA GUIDELINES

- Bankruptcy Ch 7 – You may apply for a VA guaranteed loan TWO (2) years after a chapter 7 Bankruptcy

- Bankruptcy Ch 13 – If you have finished making all payments satisfactorily, the lender may conclude that you have reestablished satisfactory credit.

- If you have satisfactorily made at least 12 months worth of the payments and the Trustee or the Bankruptcy Judge approves of the new credit, the lender may give favorable consideration.

- Foreclosure – You may apply for a VA guaranteed loan TWO (2) years after a foreclosure

- Short Sale / Deed in Lieu – You may apply for a VA guaranteed loan TWO (2) years after a short sale, unless it was a VA loan then restrictions apply

- Credit must be re-established with a minimum 620 credit score

Application Date must be after the above waiting period to be eligible for VA financing after hardship.

2017 USDA GUIDELINES

- Bankruptcy – You may apply for a USDA rural loan THREE (3) years after the discharge of a Chapter 7 or 13 Bankruptcy –

- Foreclosure – You may apply for a USDA rural loan THREE (3) years after a Foreclosure –

- Short Sale / Deed in Lieu of Foreclosure – If you had big issues the deed in lieu of foreclosure will be viewed as a foreclosure and you would want to wait no less than 3 years if the score is under 640. Over 640 your UW will make the call but typically not less than one year.

- UPDATED 12/2014 – Mortgage debt included in Bankruptcy will go by BK discharge date, and subsequent foreclosure, short sale, or deed in lieu of foreclosure will not count as an additional waiting period, as long as you are off title for any defaulted mortgages.

- Link to 12/1/2014 USDA Guideline – HB-1-3555 Attachment 10-B See Page 4 of 6

Date of Credit Approval must be after the above waiting period to be eligible for USDA financing after hardship.

2017 CONVENTIONAL (FANNIE MAE) GUIDELINES

- Bankruptcy – You may apply for a Conventional, Fannie Mae loan after your Chapter 7 bankruptcy has been discharged for FOUR (4) years, TWO (2) years from the discharge of a Chapter 13

- Foreclosure – You may apply for a Conventional, Fannie Mae loan SEVEN (7) years after the sale date of your foreclosure. Additional qualifying requirements may apply,

- Short Sale / Deed in Lieu of Foreclosure –

- UPDATED – Effective 7/29/2014: Waiting period for subsequent foreclosure that was included in Bankruptcy is waived. If mortgage is included in Bankruptcy, waiting period defaults to FOUR (4) from the discharge date.

- UPDATED – Effective 8/16/2014: Short Sale or Deed in Lieu of Foreclosure not included in a Bankruptcy has a new Waiting Period of FOUR (4) years from date your name is removed from title. This replaces the ability to buy in 24 months with 20% down payment and minimum 680 credit score.

- SEVEN (7) Years above 90% Loan to Value | with less than 10% Down Payment – Subject to Private Mortgage Insurance underwriting guidelines.

Credit must be re-established with a minimum 620 credit score.

Click Here to Contact Doug Haldeman

Fannie Mae has reduced waiting periods in cases of extenuating circumstances – The death of a primary wage earner seems to be the only one I have been able to identify up to this point.

Date of Credit Report must be after the above waiting period to be eligible for Conventional financing after hardship.

2017 JUMBO MORTGAGE GUIDELINES

- Bankruptcy – You may apply for a Jumbo mortgage loan once any chapter of bankruptcy has been discharged for FOUR (4) years, FIVE (5) years if multiple bankruptcy occurs on credit profile.

- Foreclosure – You may apply for a Jumbo mortgage loan SEVEN (7) years after the sale date of your foreclosure. Additional qualifying requirements may apply,

- Short Sale / Deed in Lieu of Foreclosure – You may apply for a Jumbo mortgage loan:

- SEVEN (7) Years from Short Sale or Deed in Lieu of Foreclosure with Maximum 80% Loan to Value

- NOTE: There are investors out there that will allow you to buy again in FOUR (4) years after a short sale, but expect higher rates, higher fees, and possibly larger down payment requirement. Jumbo lenders have not yet loosened up the qualifying guidelines for buying after a hardship.

- It may make financial sense to consider a portfolio Jumbo lender that offer high rates, so that you can take advantage of today’s market. Once your short sale is seasoned, refinance into a more favorable, longer term loan.

NOTE: If hardship is the result of an extenuating circumstance, waiting periods may be reduced. Contact lender for details.

PREPARING TO BUY AGAIN

You should begin looking at your credit at least six (6) months before you are ready to buy again.

Quite often there are things left over on your credit report that can delay your ability to qualify.

With a little head start and good advice, you can get your credit in line, qualify for financing and buy again in the lowest priced real estate market that California has seen in years and years!

We specialize in these situations so feel free to drop me an email, call or leave a question below.

Podcast: Play in new window | Download