A long time ago, in a country far, far away… wait…the country was the good old U.S. of A. and we were in the Great Depression. The government stepped in a variety of ways. They felt that the country needed a little help lifting itself out of this Depression as part of Franklin Delano Roosevelt’s New Deal , and did so by creating such agencies as the Public Works Projects and the Fair Housing Act. They later created the government backed company Federal National Mortgage Association.

A long time ago, in a country far, far away… wait…the country was the good old U.S. of A. and we were in the Great Depression. The government stepped in a variety of ways. They felt that the country needed a little help lifting itself out of this Depression as part of Franklin Delano Roosevelt’s New Deal , and did so by creating such agencies as the Public Works Projects and the Fair Housing Act. They later created the government backed company Federal National Mortgage Association.

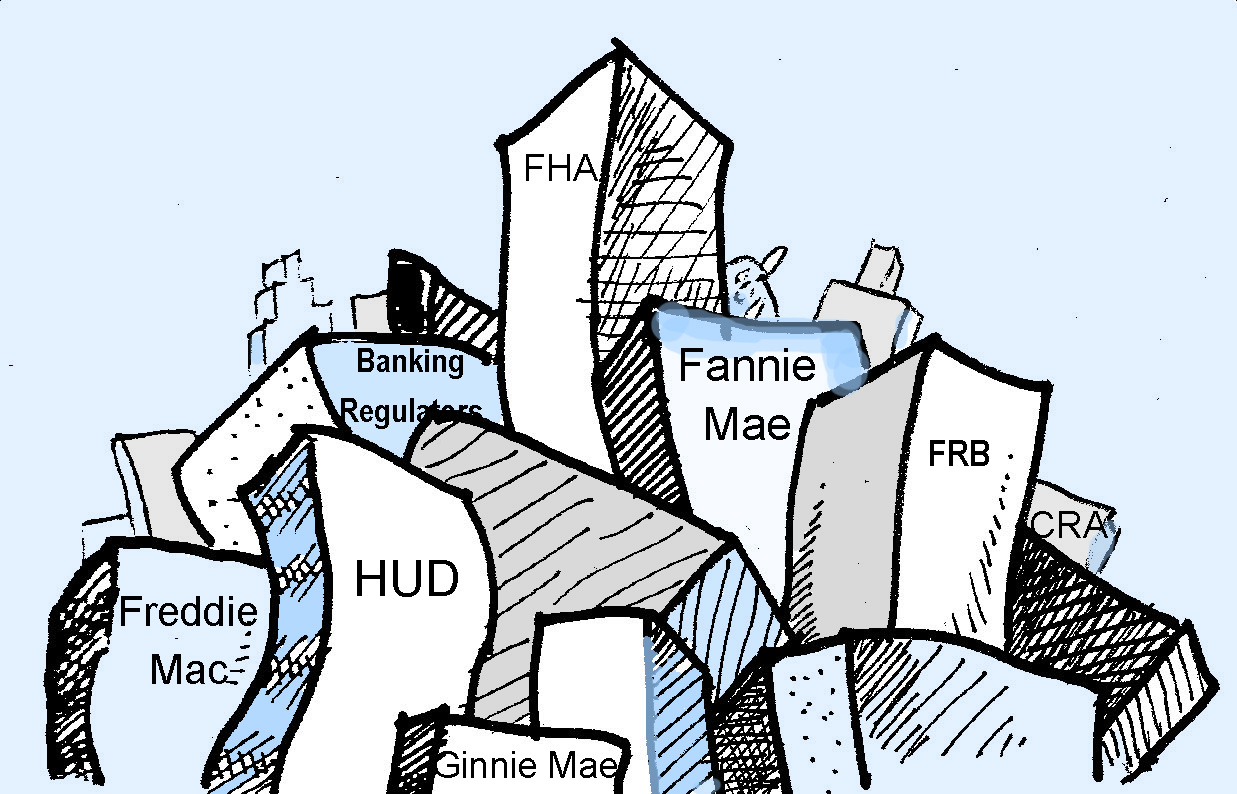

This government program called FNMA or Fannie Mae for short was to created in 1938 as a company who would help low, moderate and middle income families realize what has been referred to as the “American Dream”, home ownership.

Ginnie Mae, or GNMA, Government National Mortgage Association provides a link between capital markets (the lenders) and the Federal Housing markets. This makes Mortgage backed Securities more attractive to investors, such as pension funds and the like. The main difference between this company and Fannie Mae lies in the government backing. While the backing is only perceived in Fannie Mae, it is real in the case of a Ginnie Mae backed security or mortgage. 95% of all home loans through FHA (Federal Housing Authority) and the VA (Veterans Administration) are backed by GNMA.

What this means to the lender or the investor who buys their backed securities is that they will get paid, even if the borrower doesn’t make the payments and defaults on the loan. This government backing does not allow them to make riskier bets on the mortgage market, but allows them to make available loans in a rural and urban areas that are not the most desirable lending atmospheres.

This company was originally part of its older sister, Fannie Mae, and was created as one of the recovery steps taken by the government during the Depression. The National housing Act created the FHA, which eventually charted the National Mortgage Association of Washington and then again as the Federal National Mortgage Association (FNMA, or Fannie Mae). This company became a mixed ownership company with the government owning preferred stock, while the public held the common stock. In 1968, this was further divided with Fannie Mae becoming wholly a public owned company traded on the NYSE, and Ginnie Mae was spun off as a government owned association.

So they do the same thing, with the exception of how the money is raised, whether publicly as a traded company, or privately as a government backed entity. Ginnie Mae, is the lending branch of HUD, which is the enforcement arm of the government insuring that housing and the purchase of housing is a nondiscriminatory event.

HUD is involved with the government as the strong arm of the Fair Housing Act, helping communities develop and grow into livable and viable places. The branch of HUD that works with lenders is the FHA (Federal Housing Administration). The FHA provides the loans, which have limits (to find out what they are, click here) but the down payment requirements are usually lower than conventional loans. The goal behind HUD is affordability. They want home ownership to become a reality.

And then there is Freddie Mac. This is also a governmental creation and in fact, five of the eighteen members of its board are appointed by the President. This company is also a buyer of mortgages on the secondary market. Like Fannie Mae, Freddie Mac provides money to lenders to continue their efforts at selling mortgages. This keeps the market liquid, which is just another way of saying that it will remain funded. Remaining funded means that money will be there it lend, and the interest rates are kept lower as a result. Money supply is the key element here. Freddie Mac, like Fannie Mae, is a publicly traded company and has been for thirty years.

In all likelihood, you have benefited from these companies at one time or another, and probably didn’t even know how.

For more information regarding your loan you can contact Doug directly:

Doug Haldeman